What is a Forex Margin Calculator?

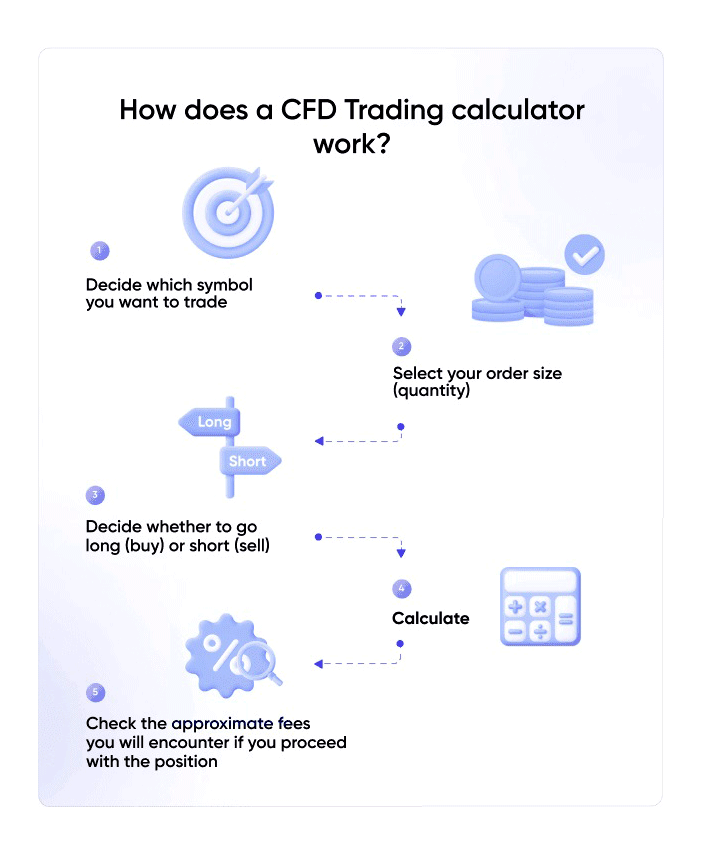

Required margin is percentage of the full value of a position that you need to possess in order to enter a position. Our forex margin calculator is a tool designed to calculate the approximate required margin for the desired by your position size and direction.

What is leveraged trading, why it is important?

Trading on leveraged capital means that you can trade amounts significantly higher than the funds you invest, which only serve as the margin. High leverage can significantly increase the potential return, but it can also significantly increase potential losses. As our client, you can trade with amounts many times higher than you could invest in a particular CFD without the margin we provide. Sometimes leverage is expressed in percentage terms – and referred to as Margin Requirement. For example, a leverage of 1:30 is a margin requirement of 3.34%.

What is a Margin Call, How Can I Avoid It?

- In order to maintain your open positions 50% margin level is the minimum level. Should your margin level fall below the minimum, we reserve the right to liquidate any open position, until your accounts margin level rises above the 50%.

- In the event that your margin level drops below 100%, you will not be able to open any new positions.

- In the event that your margin level reaches 70%, we will send you a margin call, meaning an email and/or any other notification. This notification acts as an early warning of the performance of your open positions with us.

How is Forex Required Margin calculated? Do I have enough funds to open a position?

Initial/required Margin refers to the amount you are required to have at the time of opening a position. “Initial margin %” is determined by the Company in its sole discretion in respect of each underlying Financial Instrument. The required margin is derived from the formula: Used Margin + (amount*spread)

Need more information?

See all FAQs

Can I convert currencies using my Investous.pro account?

Can I trade FX CFDs on any platform offered by Investous.pro?

What is the difference between base and quote currency?