What is a CFD Trading Calculator?

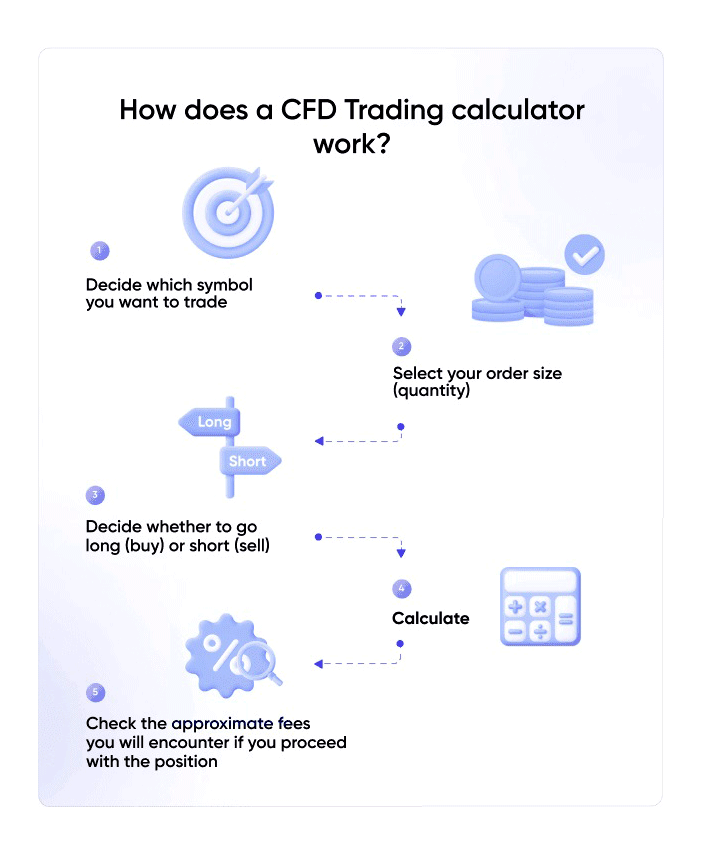

The 4xvc.com Trading Calculator is a simple tool designed to calculate your hypothetical P/L (aggregated cost and charges) if you had opened a trade today. Using our calculator, you can easily evaluate any position you already hold or are about to open by calculating its spread, margin requirement, overnight swap and more.

How can I get started with Trading?

- Open an account with 4xvc.com. Access via our app or online.

- New to trading? We have you covered with trading tools, training and 24/5 customer service.

- Experienced in trading? We have the tools and insights you need to grow your trading portfolio.

Need more information?

See all FAQs

How to calculate Pip value?

Pip Value can be variable or fixed, depending on two factors:

1. The currency pair traded, (for example: EUR/USD).

2. The base currency, (for example: EUR of the EUR/USD currency pair is the measuring currency).

To calculate pip value, divide one pip (usually 0.0001) by the current market value of the forex pair. Then, multiply that figure by your lot size, which is the number of base units that you are trading. This means that the value of a pip will be different between currency pairs, due to the variations in exchange rates.

What spreads do 4xvc.com offer?

How can I open Entry Limit/Entry Stop Orders?

To open one of the above orders, select your direction (Buy or Sell) and from the New Order window, follow up by clicking on the ‘Advanced’ option.

If you have selected Buy, you will be allowed to place a Buy Limit or Buy Stop Order. If you have selected Sell, you will be allowed to place a Sell Limit or Sell Stop Order.

What is a Stop Loss/Take Profit?

Stop Loss and Take Profit are protection orders which allow you to protect yourself against further losses or lock-in your profits when you are not able to monitor your positions.

Stop Loss limits an investors loss on a specific level. On our platform stop-loss can be set based on rate, USD value, % of Margin.

Take Profit fills only when the predefined instrument price is reached. On our platform take-profit can be set based on rate, USD value, % of Margin.