What is a Forex Profit Calculator?

A forex profit calculator is a tool used by forex traders to calculate the profit or loss from a particular trade. This calculator factors in a trader’s entry and exit price, the currency pair being traded, the number of units, the cost of spread and rollover, as well as any applicable commissions. It helps traders accurately calculate potential profits or losses in advance and understand the risks of the trade. Forex profit calculators also provide a helpful way to compare potential profits across different currency pairs, or to check the performance of a single currency pair over time. Investous.pro offers a forex profit calculator right on the platform to help traders make more informed decisions as they trade.

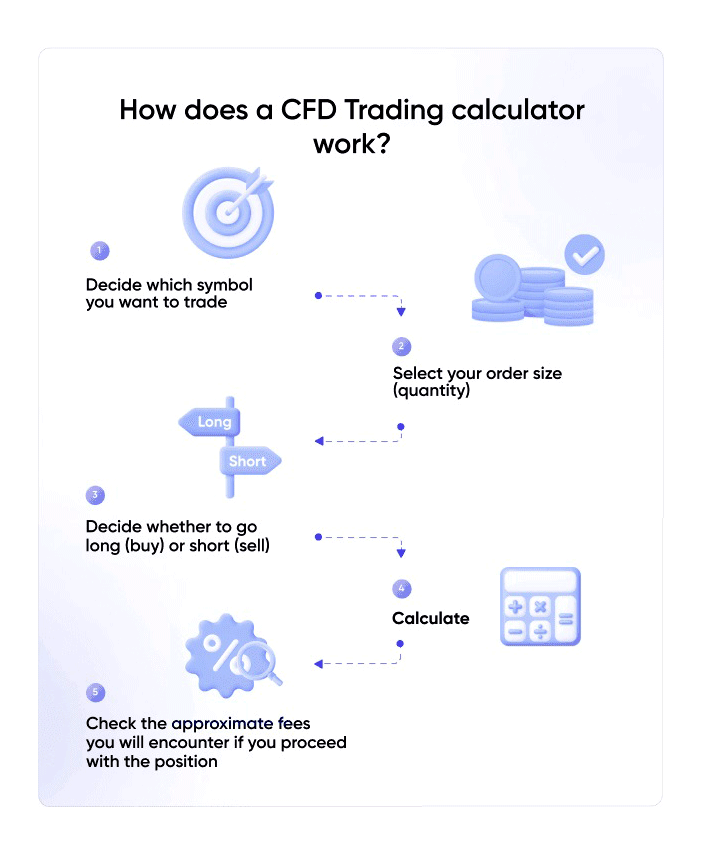

How Does a Forex Profit Calculator Work?

You might find yourself asking, ‘How Can I Calculate Profit in Forex?’, or ‘How do you calculate profit or loss in forex trading?’. Well fortunately for you, the Investous.pro forex profit calculator makes things easy. The calculator is designed to help you calculate potential gains and losses on each currency trade. Simply input the values requested: the currency pair being traded, the position size, entry price, and the exit price to accurately determine potential gains or losses. The Investous.pro calculators already include spreads when determining the outcome and the 0% commission we offer on the platform. With this information, the calculator can quickly and accurately determine how much you would hypothetically make or lose on a trade.

How is Profit Calculated in Forex Trading?

Profit in forex trading is calculated by subtracting the entry price from the exit price of a trade. This can be in either a positive or negative value depending on whether the trade resulted in a loss or gain. Forex traders will look to open a trade at a lower price and close it at a higher price, in order to turn a profit.

However, you don’t need to do these calculations manually as Investous.pro offers a commodity calculator that does the job for you. You simply need to input the necessary information, and the calculator will provide you with the estimate profit or loss amount. This makes the process simple and convenient, allowing you to focus on making informed trading decisions.

Conclusion

In conclusion, forex trading can be a complex and risky business, but with the help of a Forex Profit Calculator, traders and investors can make informed decisions and manage their risks. The calculator provides quick and accurate profit/loss estimates, taking into account various input parameters such as the current market price, quantity, and any transaction fees or spreads. The Investous.pro forex calculator is an example of such a tool, and it can make the task of risk management much more digestible. By using a Forex Profit Calculator, traders can focus on making informed decisions, without having to worry about the complexities and inaccuracies of manual calculations.

FAQs About Our Forex Profit Calculator

See all FAQs

What is the difference between base and quote currency?

How is forex profit and loss calculated?

Forex profit and loss is calculated based on the difference between the purchase and sale price of a currency pair. If the sale price is higher than the purchase price, the trader makes a profit. Conversely, if the sale price is lower than the purchase price, the trader incurs a loss. The profit or loss amount is calculated in the base currency of the account and is influenced by factors such as lot size, leverage, and pip value.